Migrating to cloud for digital transformation in finance

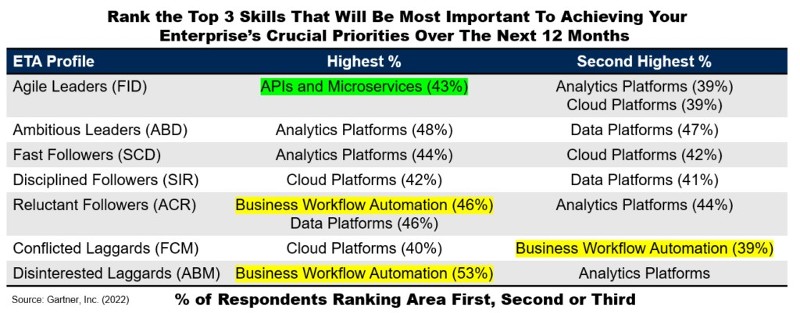

Digital transformation of financial services companies with the cloud means designing and deploying (or migrating) apps for digitizing operations and functions. “Cloud, Analytics, and Data are in the “everyone is doing it stage”, but likely with different needs in terms of the level of support,” suggests Gartner in its survey- what skills are important to CIOs by Enterprise Technology Adoption (ETA). Cloud platforms account for 42% for the Disciplined Followers ETA profile (refer to Fig. 1).

Digital transformation in finance with cloud migration?

Cloud migration for digital transformation in finance can be understood as the practice of storing data without having a need for IT infrastructures. The technology has now become useful for most automation solutions since functionalities and back-end processes do not require on-premise storage of data. With this, the entire responsibility of managing the platform is delegated to the developers. Moreover, the cloud helps in 24*7 remote working and online accessibility- all by authorized login credentials. This means that the financial tasks and their progress can be monitored remotely at an independent location.

Public cloud infrastructure as a service suffered 60% fewer security incidents than those in traditional data centers, claims Gartner. Data privacy is thus a clear benefit of the cloud for the digital transformation of financial services. Gartner argues that “security should no longer be considered a primary inhibitor to the adoption of public cloud services.” In financial institutions, data security is the paramount concern, and cloud solutions offer enhanced data protection.

Migrating your current apps to the cloud can offer other strategic benefits such as a reduction in license fees, full compliance, and improved organizational performance. When companies move their legacy systems to the cloud, they choose a digital model that offers cost-effectiveness, data security, movability, and protection.

Moving legacy infrastructure to the cloud

About 1/5th of modern companies are now spending time and investment in building such applications which do not require any network perimeter. These are called zero-rust applications. At the higher level, financial services companies can focus on security, and fixing compliances, and then move to system optimization, or the second option is to optimize all applications together.

What migrating path a company is choosing, largely depends on the risk factor. Is your company willing to underwrite certain kinds of risks associated with migration?

If a financial service company chooses to migrate first and then optimize, they can easily break through congestion, which forms a major pain point for most financial companies on the digital transformation path. This can be considered an ideal cloud migration strategy for financial companies, but it also means that leadership accepts that some apps can cost high in the immediate run.

Rewriting existing apps to cloud-native platforms

The highest investment that a financial company would make shall be in rewriting their existing applications. Despite being a costly affair, making existing apps cloud-native would still yield the most benefit in terms of ownership cost and agility.

Proprietary services of tech vendors help in rewriting or migrating current applications by configuring them for the cloud environment.

Define a clear strategy for digital transformation in finance

CIOs of financial companies must define a strategy that can replace their legacy system by leveraging the cloud. The clarity in what exactly a company needs to derive out of its cloud transformation can establish a business case for workloads and apps that can help organizations the most with early cloud migration.

On your road to digital transformation in finance with cloud, a holistic product engineering company can help meet your requirements of cloud, platform, and DevOps teams. How are you planning to deploy your cloud transformation strategy? Let us know in the comments section below.