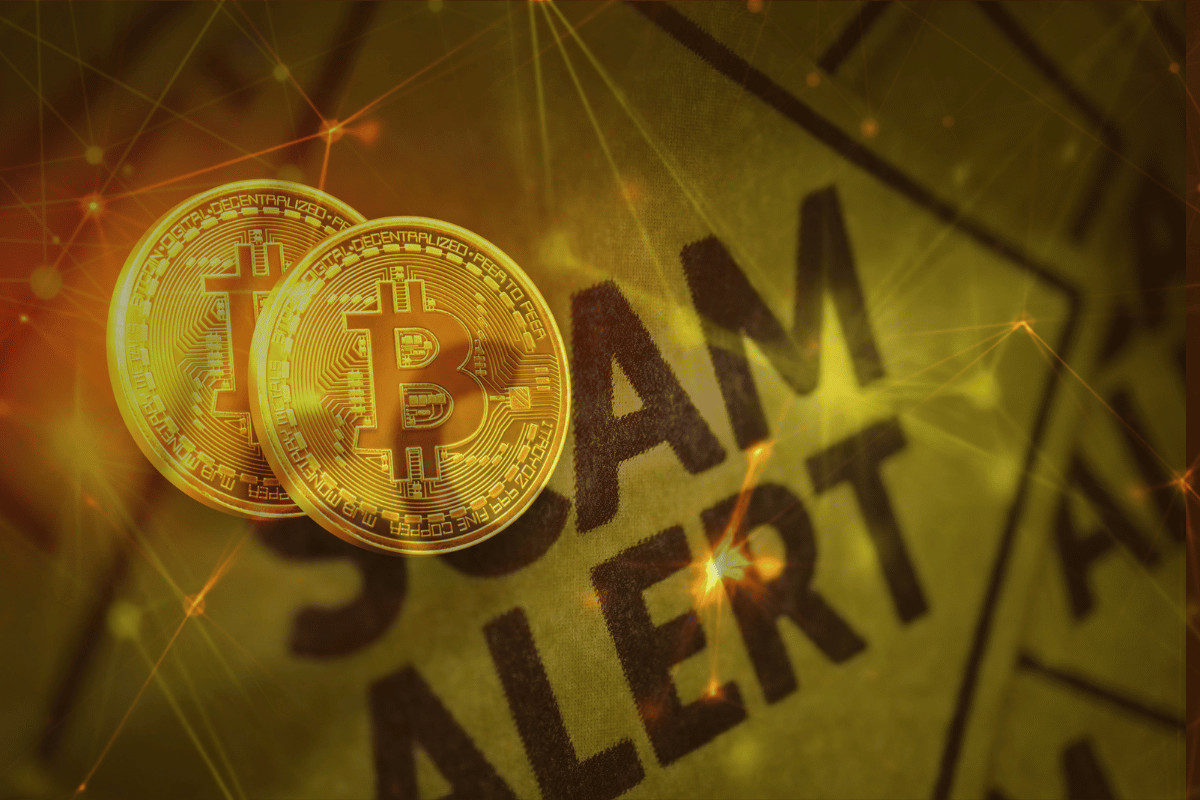

BBB Issues Warning on Cryptocurrency Investment Scams: What Businesses Should Know

As cryptocurrency continues to dominate headlines and attract attention from investors worldwide, it has also become a prime target for scammers. Recently, the Better Business Bureau (BBB) issued a stark warning about a rise in investment scams involving cryptocurrency. This advisory highlights the growing concerns surrounding fraudulent schemes that exploit the complexity and anonymity of digital currencies to deceive unsuspecting individuals and businesses. Understanding this trend and its impact is crucial for protecting your assets and reputation.

Understanding the BBB's Warning on Crypto Scams

The BBB’s alert is a direct response to an unprecedented spike in reports of cryptocurrency investment scams in 2023. The organization has observed a disturbing pattern: fraudsters are leveraging cryptocurrency’s allure and confusion to target victims. Many of these scams begin with unsolicited investment advice or seemingly innocuous introductions via social media platforms or messaging apps like WhatsApp.

One common scam tactic involves building trust through online relationships, especially on dating platforms. After establishing a rapport, scammers introduce the topic of cryptocurrency and lure individuals into fraudulent investment schemes. In other cases, hacked social media accounts of friends and family are used to post about investment opportunities, leading to more unsuspecting victims.

The Alarming Rise of Cryptocurrency Scams

According to the BBB, the average financial loss from investment scams has surged dramatically. In 2021, victims typically lost around $1,000. By 2023, that figure had ballooned to nearly $6,000 per victim. Even more troubling, the Federal Trade Commission (FTC) reported that consumers lost a staggering $4.6 billion to investment scams last year, more than any other category of fraud.

The complexity of cryptocurrency plays a significant role in enabling these scams. Many people, even experienced investors, are not entirely familiar with how cryptocurrency works, making it easier for fraudsters to deceive them. Moreover, the decentralized nature of digital currencies and their rapid rise in popularity have left many unaware of the risks involved, allowing scams to flourish unnoticed until it's too late.

Why This Warning Is Critical for Businesses

For businesses, especially those operating in the financial sector, this trend poses a serious threat. As cryptocurrency becomes more integrated into mainstream financial systems, companies are increasingly exposed to scams that target both their customers and employees. Hackers and fraudsters may use similar tactics, such as phishing, social engineering, or even direct outreach via platforms like LinkedIn, to compromise business accounts and siphon off cryptocurrency investments.

More importantly, businesses risk reputational damage if they or their clients fall victim to these scams. A breach of trust due to a scam can lead to lost clients, diminished market credibility, and regulatory scrutiny. Therefore, businesses must adopt proactive measures to educate their teams about the dangers of cryptocurrency scams and implement safeguards to protect sensitive financial transactions.

Key Takeaways to Avoid Investment Scams

To safeguard both individuals and businesses, the BBB has provided several crucial red flags and preventive measures to help avoid falling victim to investment scams:

- Beware of guarantees: No legitimate investment opportunity will promise "guaranteed" returns or low-risk, high-reward outcomes. These are classic warning signs of a scam.

- Avoid high-pressure tactics: Scammers often create urgency by applying high-pressure sales tactics, sometimes during “opportunity meetings” where they push false success stories to lure victims.

- Ask critical questions: Always ask how the investment will generate profit and seek transparency. If recruiting others is a requirement, it could be a pyramid scheme.

- Verify sources: If an investment opportunity is posted on a friend’s social media account, double-check that the post is genuine. Many scammers gain access to accounts through hacking.

By staying vigilant and encouraging responsible practices, businesses can protect themselves from the financial and reputational harm associated with cryptocurrency scams.

The Future of Business Security

Businesses must stay informed, educate their workforce, and adopt strong cybersecurity practices to mitigate the risks posed by these types of scams. Implementing robust security measures, such as two-factor authentication and employee training on recognizing scams, can significantly reduce the chances of falling prey to fraudulent schemes.

Moreover, as cryptocurrencies become more mainstream, businesses must collaborate with cybersecurity experts to ensure they’re adequately prepared to navigate the challenges of handling digital currencies.

Visit our website today for more insights and actionable solutions. Learn more about how to navigate the challenges of cryptocurrency and ensure your business’s financial security.